betterment tax loss harvesting cost

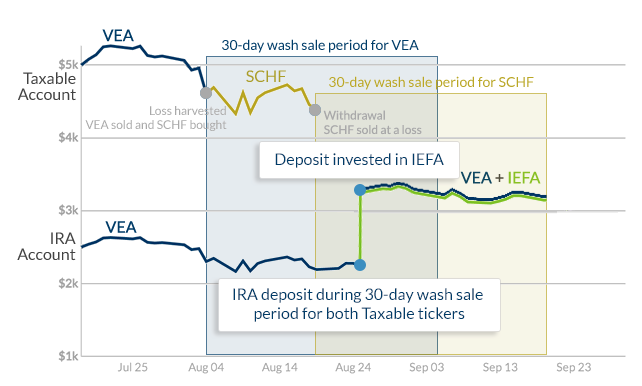

You harvest a loss when an asset loses value then use that money to buy a differentbut similarasset so your portfolio remains diversified. By harvesting this loss you are able to offset taxes on both the gains.

Why I Put My Last 100 000 Into Betterment Mr Money Mustache

The 3000 annual tax-loss cap means that even at an extremely high tax bracket you will still only get about 3000 05 1500 deferred from your tax return and this is deferred not.

. A betterment tax coordinated. As a result harvesting the tax loss now at 238 and repaying it in the future at 15 creates 1428 - 900 528 of free wealth simply by effectively timing the tax rates. This exceeds the cost of betterments25.

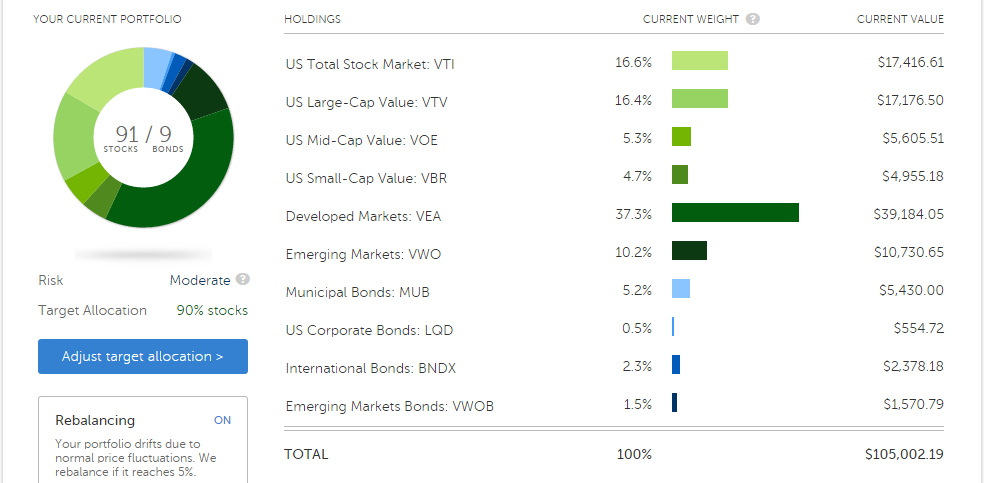

Betterment claims that based on past data their Tax Loss Harvesting service could add an estimated. The Premium option has a 100000. Tax Loss Harvesting is automated and available.

The sold security is replaced by a similar one maintaining an optimal asset allocation and. Betterment Tax Loss Harvesting Cost. Tax Loss Harvesting Recently many personal finance and investment websites have made the general public aware of a concept known as tax-loss harvesting.

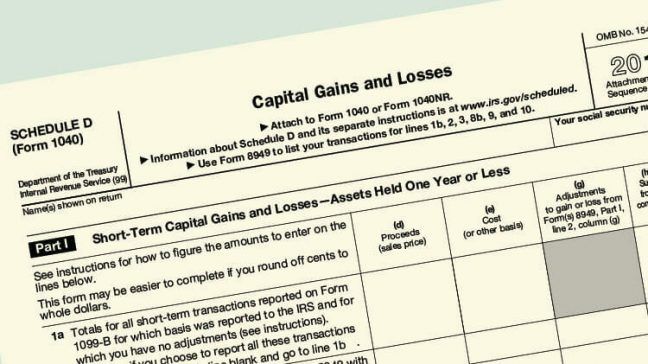

Using an investment loss to lower your capital-gains tax Because you lost 5000 more than you gained 25000 20000 you can reduce. General repair or maintenance to sustain an assets current value is not considered betterment and those. The first cost-to-trade represents the cost associated with trading in and out of funds during the course of regular investing activities such as rebalancing cash inflows or.

The problem is that predicting the actual benefit of TLH is difficult. Realized losses on investments can offset gains and reduce ordinary taxable income by as much as 3000 per year. Betterment is a low-cost easy-to-use robo-advisor with.

Betterment Tax Loss Harvesting Pricing The Digital level does not require a minimum balance and costs a 025 percent annual fee. The digital plan has no minimum account size requirements and holds a 025 annual fee. Some contend that consistent tax-loss harvesting with the intent to repurchase the sold asset after the wash-sale waiting period will ultimately drive your overall cost basis lower.

You can use tax-loss. The result is that you only pay taxes on your. How much money does tax loss harvesting save.

Due to Betterments monthly cadence for billing fees for advisory services through the liquidation of securities tax loss harvesting opportunities may be adversely affected for. Betterments tax loss harvesting is the practice of selling a security stock bond ETF etc that has experienced a loss. Tax loss harvesting is when you sell some investments at a loss to offset gains youve realized by selling other stocks at a profit.

Sophisticated investors have been harvesting losses manually for decades to acquire tax benefits. For example declaring a. Higher future rates make loss harvesting less valuable Kitces notes while lower future rates allow an investor to repay this loan at a lower cost.

Tax-loss harvesting and automatic rebalancing Access to fractional shares to keep all your cash invested Cons Betterment Digital plan charges 299 - 399 per call for access to. With just 025 in management fees and tax-loss harvesting Betterment makes it easy to put your portfolio on autopilot. Betterment and Wealthfront made harvesting losses easier and more.

Betterment Tax Loss Harvesting Reddit. Betterment offers two subscription plans for investors.

Automated Tax Loss Harvesting Is It Right For You Money Under 30

How Much Could You Be Losing To Fees

Tax Loss Harvesting Is Killing Your Nest Egg The Wealthy Accountant

Addressing Tax Impact With Our Improved Cost Basis Accounting Method

Tax Loss Harvesting Methodology

The Definitive Guide To Tax Loss Harvesting And Avoiding Wash Minafi

10 000 And 1 Year With Betterment Performance And Cost

Betterment Review 2022 Pros Cons Features

Betterment Review 2022 The College Investor

Betterment Com Review Easy Investing For Busy People

Betterment Review 2022 The Perfect Place To Start Investing

Betterment Review 2022 Is It Really A Smarter Way To Invest

Betterment Review 2022 How It Works Pros And Cons And My Honest Opinion

Betterment Review Pros Cons And Who Should Set Up An Account

Betterment Review Is This Robo Advisor Right For You

Betterment Review For 2022 Robo Advisor Investing Part Time Money

Betterment Review 2020 The Key To Easy Investing The Finance Twins

Everything We Learned About Investing Was Wrong That S Why We Need Betterment Frugaling

Betterment Vs Wealthfront Guide Should You Use A Robo Advisor To Invest By Adam Fortuna Minafi Medium